Understanding Self-Employed Housekeeper Tax Return: A Comprehensive Guide

Self-employed housekeepers play a crucial role in maintaining the cleanliness and organization of homes, especially in a fast-paced world where time is of the essence. However, with the freedom of being self-employed comes the responsibility of understanding the tax implications associated with this profession. Navigating the complexities of tax returns can be daunting, but it is essential for all self-employed housekeepers to grasp how to accurately file their taxes and ensure compliance with tax laws. In this article, we will explore the essential aspects of tax returns for self-employed housekeepers, including expenses that can be deducted, record-keeping tips, and common pitfalls to avoid. By the end of this guide, you will be equipped with the knowledge needed to handle your taxes confidently.

As a self-employed housekeeper, you are classified as an independent contractor, which means that you are responsible for reporting your income and expenses on your tax return. This classification can lead to various tax obligations, including self-employment tax, which is a combination of Social Security and Medicare taxes. It’s important to understand how to calculate these taxes, as well as how to report them accurately to avoid penalties.

The landscape of tax regulations is continually evolving, making it imperative for self-employed individuals to stay informed about their obligations. This article will not only address the fundamentals of filing a tax return as a self-employed housekeeper but will also provide insights into how you can maximize your deductions and minimize your tax liability. So, let’s dive into the intricacies of self-employed housekeeper tax returns!

Read also:Exploring The World Of Couple Tattoo Ideas A Comprehensive Guide

Table of Contents

- Biography of Self-Employed Housekeepers

- Understanding Tax Obligations

- Deductible Expenses for Housekeepers

- Record Keeping Tips

- Self-Employment Tax Explained

- Filing Your Tax Return

- Common Mistakes to Avoid

- Conclusion

Biography of Self-Employed Housekeepers

Self-employed housekeepers are individuals who provide cleaning and maintenance services to clients on a freelance basis. They often work independently, offering their services to residential homes, offices, and various establishments. The nature of their work allows for flexible schedules and the potential to earn a substantial income based on the number of clients and services offered.

| Name | Various Self-Employed Housekeepers |

|---|---|

| Occupation | Housekeeper |

| Employment Type | Self-Employed |

| Primary Duties | Cleaning, organizing, and maintaining homes or offices |

| Income Classification | Independent Contractor |

Understanding Tax Obligations

As a self-employed housekeeper, you need to be aware of the various tax obligations that come with your status. These include:

- Income Tax: You must report all income earned from your housekeeping services on your tax return.

- Self-Employment Tax: This tax is applicable to net earnings from self-employment, covering Social Security and Medicare.

- Estimated Taxes: You may need to pay estimated taxes quarterly if you expect to owe more than $1,000 in taxes for the year.

Deductible Expenses for Housekeepers

One of the advantages of being self-employed is the ability to deduct certain business expenses from your taxable income. Some common deductible expenses include:

- Cleaning supplies and equipment

- Transportation costs (mileage for work-related travel)

- Home office expenses (if applicable)

- Advertising and marketing costs

- Insurance premiums related to your business

How to Document Your Expenses

Proper documentation is crucial for claiming deductions. Here are some tips:

- Keep all receipts and invoices related to your business expenses.

- Use accounting software or apps to track your income and expenses.

- Maintain a mileage log if you use your vehicle for business purposes.

Record Keeping Tips

Effective record-keeping is essential for managing your finances and preparing for tax season. Here are some strategies to keep your records organized:

- Set up a dedicated file system for your business documents.

- Regularly update your financial records to reflect income and expenses.

- Consider hiring a professional accountant for assistance with tax preparation.

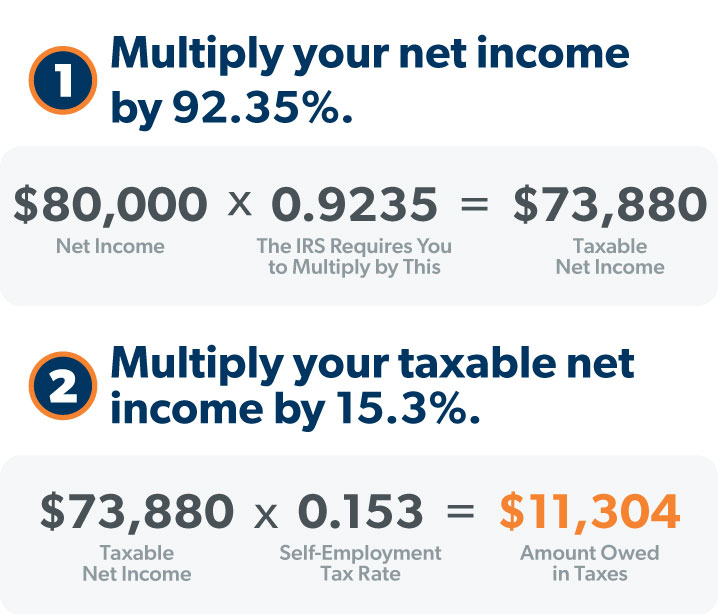

Self-Employment Tax Explained

Self-employment tax is a significant consideration for self-employed individuals. It is calculated on your net earnings from self-employment and is in addition to regular income tax. For 2023, the self-employment tax rate is 15.3%, which includes:

Read also:Latest Winners Of Taco Bells Clio Awards For Music

- 12.4% for Social Security

- 2.9% for Medicare

It’s important to calculate your self-employment tax accurately to avoid underpayment penalties.

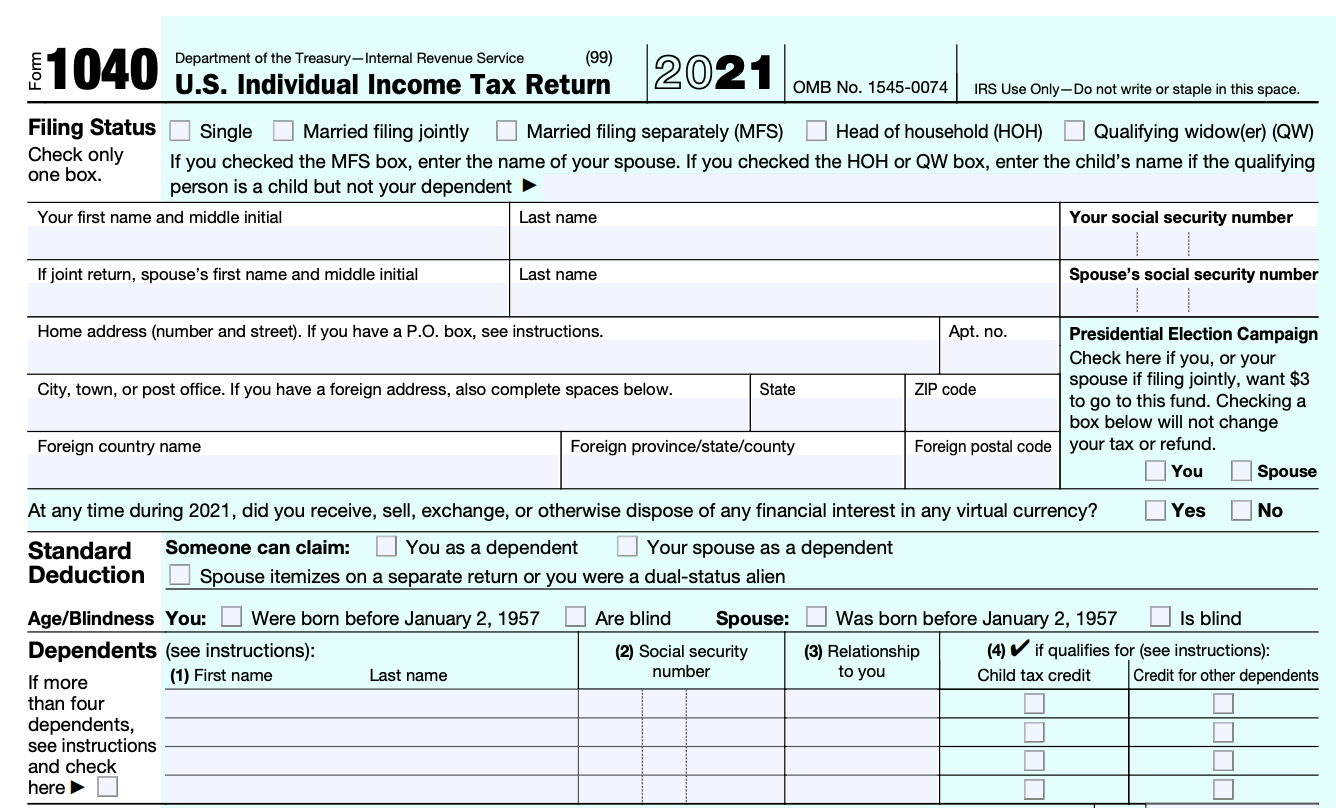

Filing Your Tax Return

Filing your tax return as a self-employed housekeeper involves several steps:

- Gather all relevant financial documents, including income statements and expense receipts.

- Choose the appropriate tax form (Schedule C for sole proprietors).

- Complete your tax return, ensuring that all income and deductions are accurately reported.

- File your tax return electronically or via mail by the deadline (April 15th for most taxpayers).

Common Mistakes to Avoid

While filing your tax return, be mindful of these common mistakes:

- Failing to report all income earned.

- Overlooking deductible expenses.

- Not keeping adequate records to support your claims.

- Missing filing deadlines, which can lead to penalties.

Conclusion

In conclusion, understanding the intricacies of self-employed housekeeper tax returns is essential for ensuring compliance with tax regulations and maximizing your deductions. Being aware of your tax obligations, maintaining accurate records, and avoiding common mistakes can significantly ease the tax filing process. If you have any questions or would like to share your experiences, please leave a comment below!

For further reading on related topics, feel free to explore our other articles on tax tips for freelancers and self-employed individuals. Remember, staying informed is key to successful tax management!

Thank you for reading, and we look forward to seeing you again soon!

Article Recommendations