Understanding The Santa Clara County CA Sales Tax Rate: A Comprehensive Guide

The Santa Clara County CA sales tax rate is a crucial aspect for both residents and business owners in the region. It impacts everything from daily purchases to significant business operations. Understanding this tax rate is essential for compliance and financial planning. In this article, we will explore the current sales tax rate, how it is structured, and its implications for consumers and businesses alike.

Sales tax is a vital source of revenue for local governments, and Santa Clara County is no exception. The funds generated from this tax contribute to public services, infrastructure, and community programs, making it important for residents to understand how it affects them. In addition, businesses must also grasp the nuances of the sales tax system to avoid potential penalties and ensure proper tax collection.

This article will cover various aspects of the Santa Clara County CA sales tax rate, including its history, the current rate, and future projections. We will also provide insights into how this tax compares to neighboring counties and what residents and businesses need to know to navigate the sales tax landscape effectively.

Read also:Understanding Quick Sort A Comprehensive Guide

Table of Contents

- History of Sales Tax in Santa Clara County

- Current Sales Tax Rate

- Comparison with Neighboring Counties

- Impact on Consumers

- Implications for Businesses

- Sales Tax Exemptions and Exceptions

- Future of Sales Tax in Santa Clara County

- Conclusion

History of Sales Tax in Santa Clara County

The sales tax in California was first implemented in 1933 as a temporary measure to address the financial challenges of the Great Depression. Over the years, the tax has evolved, with counties and cities having the authority to set their own additional taxes. Santa Clara County has seen various changes in its sales tax rate due to shifts in local governance and economic needs.

Current Sales Tax Rate

As of 2023, the overall sales tax rate in Santa Clara County is 9.25%. This rate combines the state sales tax rate of 7.25% with additional local taxes. Here’s a breakdown of the current sales tax rate:

- State Sales Tax: 7.25%

- Local Sales Tax: 1.00%

- Measure A (additional local tax): 0.50%

This total rate applies to most purchases made within the county, including retail sales, food, and services.

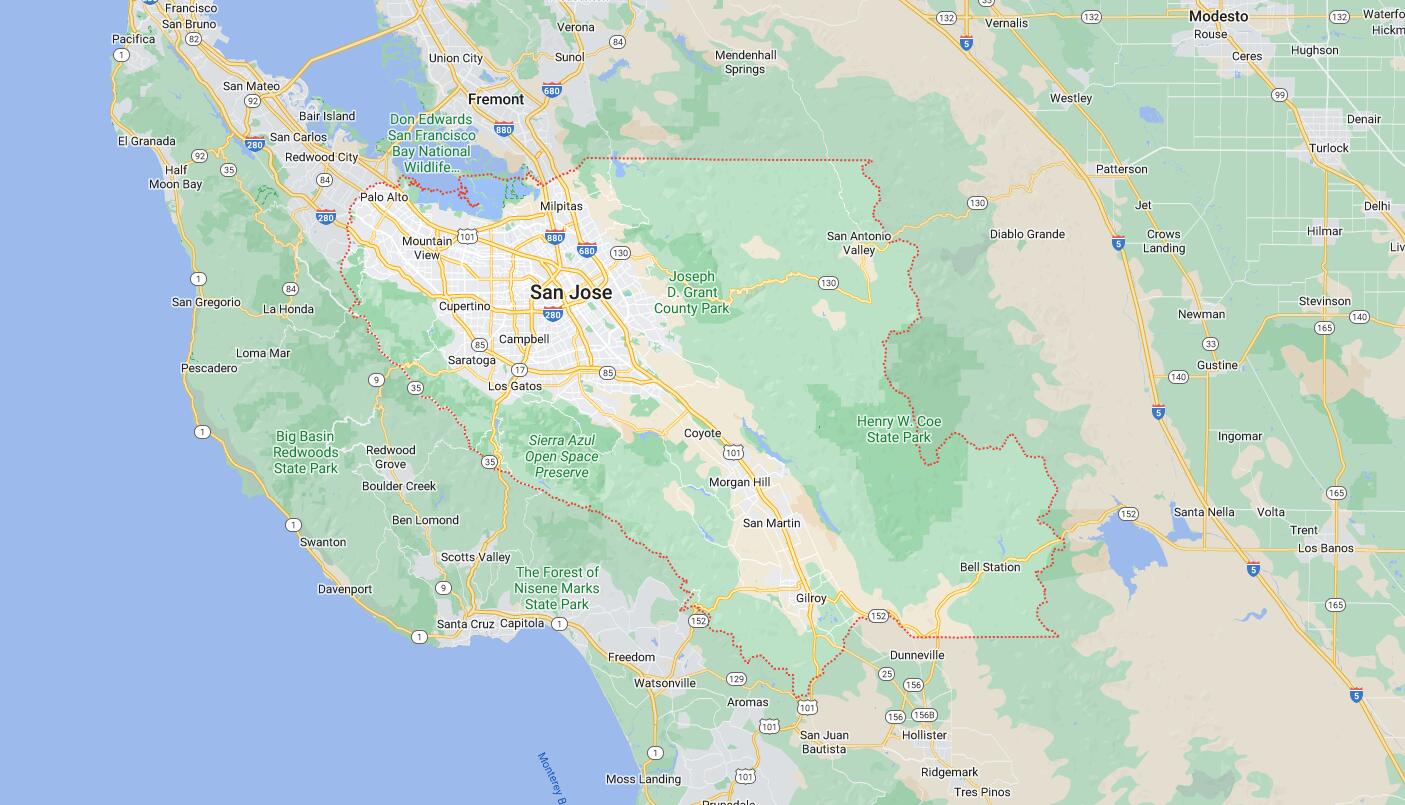

Comparison with Neighboring Counties

When comparing the Santa Clara County CA sales tax rate to neighboring counties, it is essential to consider how local rates can vary significantly. For instance:

- San Mateo County: 9.00%

- Alameda County: 10.25%

- Santa Cruz County: 9.25%

These variations can influence consumer behavior and business decisions, making it crucial for stakeholders to stay informed.

Impact on Consumers

The sales tax rate directly impacts consumers in various ways:

Read also:The Ultimate Guide To Understanding Home Warranty Companies

- Increased Costs: A higher sales tax means that consumers pay more for goods and services.

- Budgeting: Consumers must consider sales tax when budgeting for purchases, especially larger items.

- Shopping Decisions: Some consumers may choose to shop in neighboring counties with lower sales tax rates.

Implications for Businesses

For businesses operating in Santa Clara County, understanding the sales tax rate is critical:

- Compliance: Businesses must collect the correct amount of sales tax from customers and remit it to the state.

- Pricing Strategies: Companies may need to adjust their pricing strategies to account for sales tax.

- Record Keeping: Accurate record-keeping is essential for tax reporting and audits.

Sales Tax Exemptions and Exceptions

Not all purchases are subject to sales tax. Some common exemptions include:

- Food products for home consumption

- Prescription medications

- Certain nonprofit organizations

Understanding these exemptions is vital for both consumers and businesses to avoid overpaying or under-collecting sales taxes.

Future of Sales Tax in Santa Clara County

Looking ahead, the future of sales tax in Santa Clara County is likely to be influenced by various factors:

- Economic Growth: As the economy grows, tax revenues may increase, potentially leading to changes in tax rates.

- Legislation: Changes in state or local legislation can impact sales tax rates.

- Public Sentiment: Residents' attitudes towards taxes can influence local government decisions on tax rates.

Conclusion

In summary, the Santa Clara County CA sales tax rate is a vital component of the financial landscape for both consumers and businesses. Understanding the current rate, its implications, and potential future changes is essential for effective financial planning and compliance. We encourage readers to stay informed about sales tax developments and consider how these changes may impact their purchasing decisions or business operations.

If you have any questions or comments about the Santa Clara County sales tax rate, please feel free to leave your thoughts below or share this article with others who may find it useful!

Thank you for reading! We hope to see you back here for more insightful articles in the future.

Article Recommendations